How to Legally Secure a Post-Dated Check and What to Do if It Bounces

If someone owes you money and provides you with a post-dated check (e.g., a check dated two months from now), it’s important to take steps to legally protect yourself. Here’s how to proceed and what to do if the check eventually bounces:

1. Legal Protection When Receiving a Post-Dated Check (2-Month Period):

-

Written Agreement/Acknowledgement of Debt: Before accepting the check, create a written agreement or an “Acknowledgement of Debt.” This document should clearly state:

-

The total amount of money owed.

-

Details of the check (check number, bank name, date, and amount).

-

The reason for the debt (e.g., loan, sale of goods, services rendered).

-

The date on which the check is to be presented (the date two months in the future).

-

The legal consequences if the check bounces.

-

Signatures of both parties and, if possible, a witness.

-

This agreement will be crucial for any future legal action.

-

-

Verify Check Details: When you receive the check, ensure that:

-

The date on the check (two months from now) is correctly written.

-

The amount in both figures and words matches your owed amount precisely.

-

The drawer’s signature matches their bank records.

-

There are no alterations, erasures, or overwriting on the check.

-

-

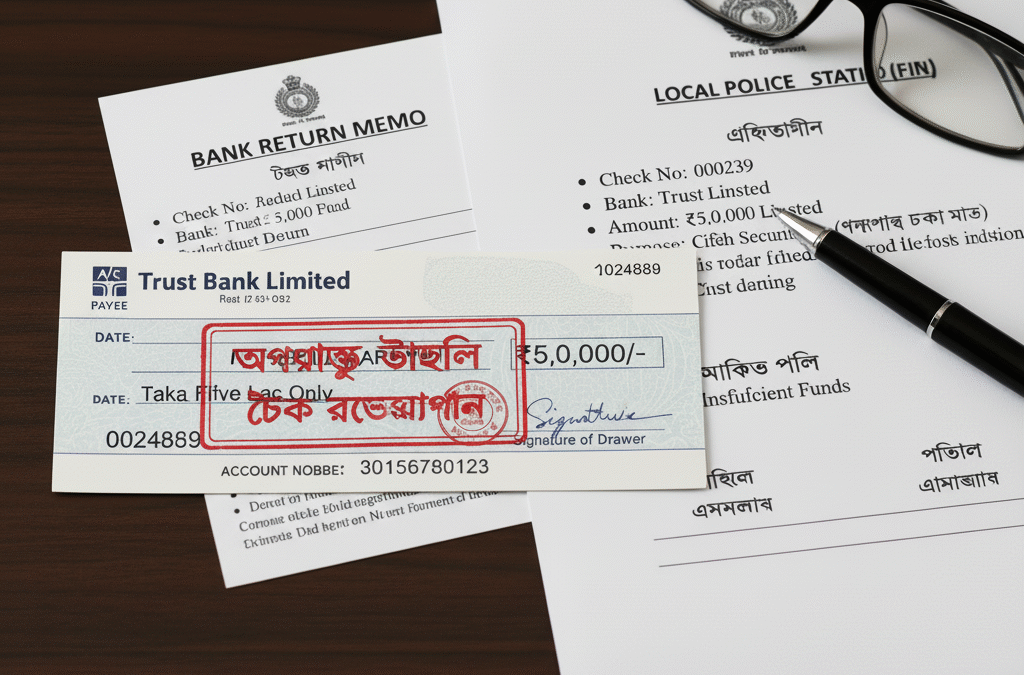

Post-dated Cheque: Since it’s a check given with a future date, it’s considered a post-dated cheque. The bank will not honor it before the date written on the check.

2. Actions and Remedies if the Check Bounces After Two Months:

If, after two months, you present the check to the bank and it bounces (due to insufficient funds or other reasons), the following steps are crucial:

Actions to Take:

-

Collect Bank Memo: Immediately after the check bounces, collect the ‘Return Memo’ or ‘Dishonor Slip’ from your bank. This is a vital document that serves as proof of the bounced check and the reason for its dishonor.

-

Send Legal Notice:

-

Within 30 days of the check being dishonored, you must send a legal notice to the drawer (the person who issued the check) via registered post or courier service.

-

The notice should clearly state:

-

Detailed information about the check (number, date, amount).

-

The reason for the check’s dishonor (as per the bank memo).

-

A demand for payment of the owed amount within a specified period (usually 30 days) from the date of receiving the notice.

-

A warning that legal action will be taken if payment is not made within the stipulated time.

-

-

It is advisable to have a lawyer draft and send this notice.

-

-

File a Case (If Payment is Not Made):

-

If the drawer fails to make the payment within the specified period after receiving the legal notice (i.e., within 30 days after the notice period expires, which is another 30 days), you can file a case against them.

-

In Bangladesh, check dishonor cases are filed under Section 138 of the Negotiable Instruments Act, 1881.

-

The case must be filed within one month after the expiry of the notice period.

-

Remedies:

-

Remedy under Section 138 of the Negotiable Instruments Act:

-

If the accused is found guilty under this section, the court can impose a fine of up to double the amount of the check, or imprisonment for a term that may extend to one year, or both.

-

The court typically directs the debtor to promptly repay the owed amount.

-

Although this case is civil in nature, its trial is conducted in criminal courts, as it is considered an offense.

-

-

Civil Suit as an Alternative:

-

In addition to or as an alternative to a criminal case, you can also file a civil suit for the recovery of money. In such a case, the court may order the repayment of the principal amount along with interest. However, this process is usually more time-consuming.

-

Important Tips:

-

Adhere to Deadlines: There are strict deadlines for sending the notice and filing the case after a check bounces. Missing these deadlines can make it difficult to seek legal remedies.

-

Correct Address: Use the correct and verified address of the check drawer when sending the legal notice. A notice sent to a wrong address may be deemed ineffective.

-

Engage a Lawyer: The legal process for check dishonor can be complex. It is highly advisable to seek assistance from an experienced lawyer.

By following these steps, you can ensure that you are legally protected when dealing with a post-dated check and have the necessary recourse if it bounces.